By Jeff Green

Nov. 19 (Bloomberg) -- Chrysler LLC Chief Executive Officer Robert Nardelli said his company studied a prearranged bankruptcy before dismissing the idea as unworkable and approaching the U.S. government for money to survive. Nardelli and General Motors Corp. CEO Rick Wagoner, who has repeatedly ruled out bankruptcy, told senators yesterday that a failure will lead to an economic ``catastrophe'' much costlier than the $25 billion in aid being proposed by Democrats. GM has said it may run out of operating cash this year.

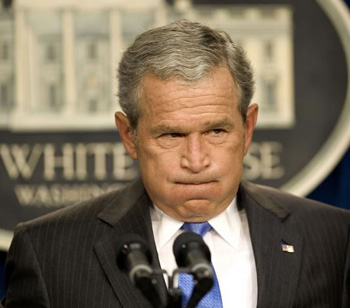

``We did look at prepackaged,'' Nardelli testified in Washington. ``We looked at pre-negotiated. We've looked at almost every alternative within Chrysler as a privately held company before we came here and ask for support to -- to provide a bridge, if you will, through this economic trough.'' His comments highlighted U.S. automakers' objections to so- called prepackaged bankruptcies, as advocated by some Republican lawmakers. While proponents say a filing with financing in hand would let GM, Chrysler and Ford Motor Co. survive, the automakers say going to court would end in their liquidation. Wagoner, Nardelli and Ford CEO Alan Mulally returned to Capitol Hill today for a House committee hearing as they seek an industry bailout before Congress's lame-duck session ends this week. Opposition from President George W. Bush and Republicans threatens to scuttle Democrats' bid to tap the $700 billion bank-rescue plan for automaker loans. A defeat may push consideration of any new aid into 2009, because House Speaker Nancy Pelosi said yesterday she doesn't intend to reconvene in December.

`Fresh Capital'

``Without fresh capital, we project that GM may not have sufficient liquidity to make it to year end,'' Deutsche Bank AG analysts including Rod Lache in New York wrote in a note to investors today. A GM bankruptcy is the ``only way'' for the biggest U.S. automaker to end union costs that make it uncompetitive, Republican Senator James DeMint of South Carolina said in an interview on Bloomberg Radio. Nardelli, who said Chrysler is down to $6.1 billion in cash and burning about $1 billion more each month, told senators yesterday that bankruptcy would take too much time.

``To a certain degree, all of these take an extensive amount of time,'' he said of the options for arranging a filing for court protection. Auburn Hills, Michigan-based Chrysler would need support from ``all the players, all of the suppliers, all of the vendors, all of the labor,'' he said.

`Very Fragile'

``In fact, we are in a very fragile position,'' he said of Chrysler, whose 26 percent U.S. sales decline this year through October is the most among major automakers. The median time for a prepackaged bankruptcy is 45 days, according to Lynn LoPucki, who teaches bankruptcy law at Harvard University and the University of California at Los Angeles. The median time for an ordinary bankruptcy is about 1 1/2 years, or more than 10 times as long, he said. For GM, a prepackaged bankruptcy plan with federal assistance would involve fewer taxpayer dollars than a bailout done outside of court, said Mark Bane, a bankruptcy lawyer at Ropes & Gray in New York. He isn't involved in GM's case. The Detroit-based automaker could use court protection to reduce debt, reject unfavorable contracts and minimize the risk that it would need a future bailout, Bane said in an interview. ``It creates the environment to deal with GM's problems, but limits government financial commitment,'' he said.

No `Stigma'

``I don't understand the stigma that would come with prepackaged bankruptcy,'' with the benefit of government funds to the industry, Tennessee Republican Senator Bob Corker said yesterday. ``I don't know how that could possibly be detrimental.'' Mulally, who said Dearborn, Michigan-based Ford isn't yet running out of money, said he expects that the bankruptcy of one automaker may lead to the failure of the others. The failure of GM would cost the government as much as $200 billion should the biggest U.S. automaker be forced to liquidate, Nariman Behravesh, chief economist at IHS Global Insight Inc. in Lexington, Massachusetts, estimates. A GM collapse would mean ``more aid to specific states like Michigan, Ohio, and Indiana, and more money into unemployment and extended benefits,'' he said Nov. 15. Aid will likely be delayed until Congress attaches more conditions, JPMorgan Chase & Co. analyst Himanshu Patel in New York wrote in a report today. ``The tone of the hearing conducted on behalf of the Senate Banking, Housing and Urban Affairs Committee and the direction of questioning did not change our view that federal aid is more likely than not,'' Patel wrote. ``However, we feel it is clearer now that the timing of any such aid is not imminent as key differences remain amongst influential power-brokers.''

Wednesday, November 19, 2008

Wednesday, November 5, 2008

Molson Coors Rises on Sales Gains, Quicker Savings

By Allison Abell Schwartz (Bloomberg)

Molson Coors Brewing Co., the third- largest U.S. beer maker, rose 8.3 percent in New York trading because of market-share gains in Canada and the U.K. and after the company said it expects to achieve total cost savings from its joint U.S. venture with SABMiller Plc six months early. Sales to retailers in Canada climbed 3.7 percent, led by “double-digit growth“ of Coors Light, Carling and Rickard’s, the company said today. Those sales gained 0.7 percent in the U.S. In the U.K., the brewer grew market share amid a slowing economy and fewer pub visits because of a smoking ban there. An increase in sales to retailers in the U.S. and Canada and Molson Coors’s cost savings announcement helped send the shares higher in New York trading today, Brian Yarbrough, an analyst at Ed Edward Jones in St. Louis, said in a telephone interview. “We are in probably the healthiest position we could wish to be in,” Chief Executive Officer Peter Swinburn said today in a telephone interview. Molson Coors, based in Denver and Montreal, climbed $3.20 to $41.78 at 4:12 p.m. in New York Stock Exchange composite trading. The shares have lost 19 percent this year. Net income jumped 29 percent to $173.2 million, or 94 cents a share, Molson Coors said in a statement. Profit excluding some one-time costs and gains was unchanged at 95 cents from a year earlier, 2 cents lower than the average estimate of 11 analysts surveyed by Bloomberg. Revenue after excise taxes dropped 45 percent to $921.1 mi million from $1.69 billion in the three months ended Sept. 28 as Molson Coors separated its U.S. operations into the MillerCoors venture. Including the U.S. business, its worldwide beer volume rose less than 1 percent to 12 million barrels.

Molson Coors Brewing Co., the third- largest U.S. beer maker, rose 8.3 percent in New York trading because of market-share gains in Canada and the U.K. and after the company said it expects to achieve total cost savings from its joint U.S. venture with SABMiller Plc six months early. Sales to retailers in Canada climbed 3.7 percent, led by “double-digit growth“ of Coors Light, Carling and Rickard’s, the company said today. Those sales gained 0.7 percent in the U.S. In the U.K., the brewer grew market share amid a slowing economy and fewer pub visits because of a smoking ban there. An increase in sales to retailers in the U.S. and Canada and Molson Coors’s cost savings announcement helped send the shares higher in New York trading today, Brian Yarbrough, an analyst at Ed Edward Jones in St. Louis, said in a telephone interview. “We are in probably the healthiest position we could wish to be in,” Chief Executive Officer Peter Swinburn said today in a telephone interview. Molson Coors, based in Denver and Montreal, climbed $3.20 to $41.78 at 4:12 p.m. in New York Stock Exchange composite trading. The shares have lost 19 percent this year. Net income jumped 29 percent to $173.2 million, or 94 cents a share, Molson Coors said in a statement. Profit excluding some one-time costs and gains was unchanged at 95 cents from a year earlier, 2 cents lower than the average estimate of 11 analysts surveyed by Bloomberg. Revenue after excise taxes dropped 45 percent to $921.1 mi million from $1.69 billion in the three months ended Sept. 28 as Molson Coors separated its U.S. operations into the MillerCoors venture. Including the U.S. business, its worldwide beer volume rose less than 1 percent to 12 million barrels.

Canadian Sales

Beer discounts and commodity inflation hurt earnings in Canada, where sales grew by a “high-single-digit” percentage, the brewer said. Profit in the country fell 8.1 percent to $151 million before taxes as the cost of goods sold rose 7 percent because of higher material, packaging material and fuel prices. Earnings in the U.K. climbed 19 percent before taxes, helped by new contracts with suppliers and lower pension costs. Sales volume declined and a 7 percent drop in the pound against the dollar trimmed profit, Molson Coors said. As commodity costs begin to slow, Molson Coors may be well positioned to boost profit, said Yarbrough, who recommends investors buy the shares.

MillerCoors Venture

Earlier today, MillerCoors reported third-quarter profit increased 15 percent to $168.2 million on sales gains of 1.9 percent, helped by purchases of Coors Light. It was the first period of joint operations. MillerCoors will cut “a lot” of jobs in the coming weeks, the unit’s executives said on a Webcast discussing earnings. The venture is the second-biggest U.S. beer company behind Anheuser- Busch Cos. and holds 30 percent of the country’s beer market. In June, Molson Coors and SABMiller joined their U.S. divisions and said they expect to save $500 million over three years from the combination. The brewer said today it anticipates accelerating by six months that savings plan, with the first $50 million by June 30 and $350 million in the second year of the venture. A year earlier, Molson Coors earned $134.7 million, or 74 cents a share.

Molson Coors Brewing Co., the third- largest U.S. beer maker, rose 8.3 percent in New York trading because of market-share gains in Canada and the U.K. and after the company said it expects to achieve total cost savings from its joint U.S. venture with SABMiller Plc six months early. Sales to retailers in Canada climbed 3.7 percent, led by “double-digit growth“ of Coors Light, Carling and Rickard’s, the company said today. Those sales gained 0.7 percent in the U.S. In the U.K., the brewer grew market share amid a slowing economy and fewer pub visits because of a smoking ban there. An increase in sales to retailers in the U.S. and Canada and Molson Coors’s cost savings announcement helped send the shares higher in New York trading today, Brian Yarbrough, an analyst at Ed Edward Jones in St. Louis, said in a telephone interview. “We are in probably the healthiest position we could wish to be in,” Chief Executive Officer Peter Swinburn said today in a telephone interview. Molson Coors, based in Denver and Montreal, climbed $3.20 to $41.78 at 4:12 p.m. in New York Stock Exchange composite trading. The shares have lost 19 percent this year. Net income jumped 29 percent to $173.2 million, or 94 cents a share, Molson Coors said in a statement. Profit excluding some one-time costs and gains was unchanged at 95 cents from a year earlier, 2 cents lower than the average estimate of 11 analysts surveyed by Bloomberg. Revenue after excise taxes dropped 45 percent to $921.1 mi million from $1.69 billion in the three months ended Sept. 28 as Molson Coors separated its U.S. operations into the MillerCoors venture. Including the U.S. business, its worldwide beer volume rose less than 1 percent to 12 million barrels.

Molson Coors Brewing Co., the third- largest U.S. beer maker, rose 8.3 percent in New York trading because of market-share gains in Canada and the U.K. and after the company said it expects to achieve total cost savings from its joint U.S. venture with SABMiller Plc six months early. Sales to retailers in Canada climbed 3.7 percent, led by “double-digit growth“ of Coors Light, Carling and Rickard’s, the company said today. Those sales gained 0.7 percent in the U.S. In the U.K., the brewer grew market share amid a slowing economy and fewer pub visits because of a smoking ban there. An increase in sales to retailers in the U.S. and Canada and Molson Coors’s cost savings announcement helped send the shares higher in New York trading today, Brian Yarbrough, an analyst at Ed Edward Jones in St. Louis, said in a telephone interview. “We are in probably the healthiest position we could wish to be in,” Chief Executive Officer Peter Swinburn said today in a telephone interview. Molson Coors, based in Denver and Montreal, climbed $3.20 to $41.78 at 4:12 p.m. in New York Stock Exchange composite trading. The shares have lost 19 percent this year. Net income jumped 29 percent to $173.2 million, or 94 cents a share, Molson Coors said in a statement. Profit excluding some one-time costs and gains was unchanged at 95 cents from a year earlier, 2 cents lower than the average estimate of 11 analysts surveyed by Bloomberg. Revenue after excise taxes dropped 45 percent to $921.1 mi million from $1.69 billion in the three months ended Sept. 28 as Molson Coors separated its U.S. operations into the MillerCoors venture. Including the U.S. business, its worldwide beer volume rose less than 1 percent to 12 million barrels.Canadian Sales

Beer discounts and commodity inflation hurt earnings in Canada, where sales grew by a “high-single-digit” percentage, the brewer said. Profit in the country fell 8.1 percent to $151 million before taxes as the cost of goods sold rose 7 percent because of higher material, packaging material and fuel prices. Earnings in the U.K. climbed 19 percent before taxes, helped by new contracts with suppliers and lower pension costs. Sales volume declined and a 7 percent drop in the pound against the dollar trimmed profit, Molson Coors said. As commodity costs begin to slow, Molson Coors may be well positioned to boost profit, said Yarbrough, who recommends investors buy the shares.

MillerCoors Venture

Earlier today, MillerCoors reported third-quarter profit increased 15 percent to $168.2 million on sales gains of 1.9 percent, helped by purchases of Coors Light. It was the first period of joint operations. MillerCoors will cut “a lot” of jobs in the coming weeks, the unit’s executives said on a Webcast discussing earnings. The venture is the second-biggest U.S. beer company behind Anheuser- Busch Cos. and holds 30 percent of the country’s beer market. In June, Molson Coors and SABMiller joined their U.S. divisions and said they expect to save $500 million over three years from the combination. The brewer said today it anticipates accelerating by six months that savings plan, with the first $50 million by June 30 and $350 million in the second year of the venture. A year earlier, Molson Coors earned $134.7 million, or 74 cents a share.

Outsource Your Collections

Debt collection is a touchy subject because of the economic climate in the US right now but still a necessity for companies. Although some companies do this in house, most businesses are looking to free up current staff and reduce overall costs that are associated with this process. We’ve been looking at a number of debt collectors and will report on them in the next few weeks. The first one we found was American Profit Recovery. They seem to have the right approach. They’ve streamlined the whole process to make it as easy as possible for a client to manage all of their accounts right on their website. Some of the pages in the site seem to be down but it looks like this is a temporary issues and I’ve been told that these kinks will be worked out soon. I’ve worked at a few companies that could have been greatly helped by APR’s work so I would recommend that if you’re looking for help with debt collection that you set up a call with them so they can answer any questions you might have. If you have used them before we’d love to hear your experiences so we encourage you to send us feedback. From all I can gather they have a great operation going.

Senior Journalist Casper Nightingale contributed to this article

Obama Is Elected President as Racial Barrier Falls

By ADAM NAGOURNEY (NYTimes)

Barack Hussein Obama was elected the 44th president of the United States on Tuesday, sweeping away the last racial barrier in American politics with ease as the country chose him as its first black chief executive. The election of Mr. Obama amounted to a national catharsis — a repudiation of a historically unpopular Republican president and his economic and foreign policies, and an embrace of Mr. Obama’s call for a change in the direction and the tone of the country. But it was just as much a strikingly symbolic moment in the evolution of the nation’s fraught racial history, a breakthrough that would have seemed unthinkable just two years ago. Mr. Obama, 47, a first-term senator from Illinois, defeated Senator John McCain of Arizona, 72, a former prisoner of war who was making his second bid for the presidency.

To the very end, Mr. McCain’s campaign was eclipsed by an opponent who was nothing short of a phenomenon, drawing huge crowds epitomized by the tens of thousands of people who turned out to hear Mr. Obama’s victory speech in Grant Park in Chicago. Mr. McCain also fought the headwinds of a relentlessly hostile political environment, weighted down with the baggage left to him by President Bush and an economic collapse that took place in the middle of the general election campaign.“If there is anyone out there who still doubts that America is a place where all things are possible, who still wonders if the dream of our founders is alive in our time, who still questions the power of our democracy, tonight is your answer,” said Mr. Obama, standing before a huge wooden lectern with a row of American flags at his back, casting his eyes to a crowd that stretched far into the Chicago night.

“It’s been a long time coming,” the president-elect added, “but tonight, because of what we did on this date in this election at this defining moment, change has come to America.” The focus shifted quickly on Wednesday to the daunting challenges facing the president-elect, with his supporters offering sober reflections of what lies ahead. “We’re in deep trouble,” said Rep. John Lewis, a Georgia Democrat and leader in the civil rights movement, on the Today show on NBC.

“We’ve got to get our economy out of the ditch, end the war in Iraq and bring our young men and women home, provide health care for all our citizens,” Mr. Lewis said. “And he’s going to call on us, I believe, to sacrifice. We all must give up something.” Mr. McCain delivered his concession speech under clear skies on the lush lawn of the Arizona Biltmore, in Phoenix, where he and his wife had held their wedding reception. The crowd reacted with scattered boos as he offered his congratulations to Mr. Obama and saluted the historical significance of the moment.

“This is a historic election, and I recognize the significance it has for African-Americans and for the special pride that must be theirs tonight,” Mr. McCain said, adding, “We both realize that we have come a long way from the injustices that once stained our nation’s reputation.” Not only did Mr. Obama capture the presidency, but he led his party to sharp gains in Congress. This puts Democrats in control of the House, the Senate and the White House for the first time since 1995, when Bill Clinton was in office.The day shimmered with history as voters began lining up before dawn, hours before polls opened, to take part in the culmination of a campaign that over the course of two years commanded an extraordinary amount of attention from the American public. As the returns became known, and Mr. Obama passed milestone after milestone —Ohio, Florida, Virginia, Pennsylvania, New Hampshire, Iowa and New Mexico — people rolled spontaneously into the streets to celebrate what many described, with perhaps overstated if understandable exhilaration, a new era in a country where just 143 years ago, Mr. Obama, as a black man, could have been owned as a slave.

For Republicans, especially the conservatives who have dominated the party for nearly three decades, the night represented a bitter setback and left them contemplating where they now stand in American politics. Republican leaders began on Wednesday what will likely be a lengthy re-examination of their brand, as Democrats hope to shape a permanent re-alignment of the electoral map. “Certainly, we have to examine this,” said Rep. Kay Bailey Hutchinson, a Texas Republican, on CNN on Wednesday. “We have to listen to what the people are saying if we’re going to be a forceful voice.” Mr. Obama and his expanded Democratic majority on Capitol Hill now face the task of governing the country through a difficult period: the likelihood of a deep and prolonged recession, and two wars. He took note of those circumstances in a speech that was notable for its sobriety and its absence of the triumphalism that he might understandably have displayed on a night when he won an Electoral College landslide.

“The road ahead will be long, our climb will be steep,” said Mr. Obama, his audience hushed and attentive, with some, including the Rev. Jesse Jackson, wiping tears from their eyes. “We may not get there in one year or even one term, but America, I have never been more hopeful than I am tonight that we will get there. I promise you, we as a people will get there.” The roster of defeated Republicans included some notable party moderates, like Senator John E. Sununu of New Hampshire and Representative Christopher Shays of Connecticut, and signaled that the Republican conference convening early next year in Washington will be not only smaller but more conservative. Mr. Obama will come into office after an election in which he laid out a number of clear promises: to cut taxes for most Americans, to get the United States out of Iraq in a fast and orderly fashion, and to expand health care. In a recognition of the difficult transition he faces, given the economic crisis, Mr. Obama is expected to begin filling White House jobs as early as this week.

Mr. Obama defeated Mr. McCain in Ohio, a central battleground in American politics, despite a huge effort that brought Mr. McCain and his running mate, Gov. Sarah Palin of Alaska, back there repeatedly. Mr. Obama had lost the state decisively to Senator Hillary Rodham Clinton of New York in the Democratic primary.

Mr. McCain failed to take from Mr. Obama the two Democratic states that were at the top of his target list: New Hampshire and Pennsylvania. Mr. Obama also held on to Minnesota, the state that played host to the convention that nominated Mr. McCain; Wisconsin; and Michigan, a state Mr. McCain once had in his sights. The apparent breadth of Mr. Obama’s sweep left Republicans sobered, and his showing in states like Ohio and Pennsylvania stood out because officials in both parties had said that his struggles there in the primary campaign reflected the resistance of blue-collar voters to supporting a black candidate. “I always thought there was a potential prejudice factor in the state,” Senator Bob Casey, a Democrat of Pennsylvania who was an early Obama supporter, told reporters in Chicago. “I hope this means we washed that away.” Mr. McCain called Mr. Obama at 10 p.m., Central time, to offer his congratulations. In the call, Mr. Obama said he was eager to sit down and talk; in his concession speech, Mr. McCain said he was ready to help Mr. Obama work through difficult times. “I need your help,” Mr. Obama told his rival, according to an Obama adviser, Robert Gibbs. “You’re a leader on so many important issues.” Mr. Bush called Mr. Obama shortly after 10 p.m. to congratulate him on his victory. “I promise to make this a smooth transition,” the president said to Mr. Obama, according to a transcript provided by the White House .”You are about to go on one of the great journeys of life. Congratulations, and go enjoy yourself.” For most Americans, the news of Mr. Obama’s election came at 11 p.m., Eastern time, when the networks, waiting for the close of polls in California, declared him the victor. A roar sounded from the 125,000 people gathered in Hutchison Field in Grant Park at the moment that they learned Mr. Obama had been projected the winner.

The scene in Phoenix was decidedly more sour. At several points, Mr. McCain, unsmiling, had to motion his crowd to quiet down — he held out both hands, palms down — when they responded to his words of tribute to Mr. Obama with boos. Mr. Obama, who watched Mr. McCain’s speech from his hotel room in Chicago, offered a hand to voters who had not supported him in this election, when he took the stage 15 minutes later. “To those Americans whose support I have yet to earn,” he said, “I may not have won your vote, but I hear your voices, I need your help, and I will be your president, too.” Initial signs were that Mr. Obama benefited from a huge turnout of voters, but particularly among blacks. That group made up 13 percent of the electorate, according to surveys of people leaving the polls, compared with 11 percent in 2006.

In North Carolina, Republicans said that the huge surge of African-Americans was one of the big factors that led to Senator Elizabeth Dole, a Republican, losing her re-election bid. Mr. Obama also did strikingly well among Hispanic voters; Mr. McCain did worse among those voters than Mr. Bush did in 2004. That suggests the damage the Republican Party has suffered among those voters over four years in which Republicans have been at the forefront on the effort to crack down on illegal immigrants. The election ended what by any definition was one of the most remarkable contests in American political history, drawing what was by every appearance unparalleled public interest. Throughout the day, people lined up at the polls for hours — some showing up before dawn — to cast their votes. Aides to both campaigns said that anecdotal evidence suggested record-high voter turnout.

Reflecting the intensity of the two candidates, Mr. McCain and Mr. Obama took a page from what Mr. Bush did in 2004 and continued to campaign after the polls opened. Mr. McCain left his home in Arizona after voting early Tuesday to fly to Colorado and New Mexico, two states where Mr. Bush won four years ago but where Mr. Obama waged a spirited battle. These were symbolically appropriate final campaign stops for Mr. McCain, reflecting the imperative he felt of trying to defend Republican states against a challenge from Mr. Obama. “Get out there and vote,” Mr. McCain said in Grand Junction, Colo. “I need your help. Volunteer, knock on doors, get your neighbors to the polls, drag them there if you need to.” By contrast, Mr. Obama flew from his home in Chicago to Indiana, a state that in many ways came to epitomize the audacity of his effort this year. Indiana has not voted for a Democrat since President Lyndon B. Johnson’s landslide victory in 1964, and Mr. Obama made an intense bid for support there. He later returned home to Chicago play basketball, his election-day ritual.

Thursday, October 30, 2008

Economy shrinks in 3Q, signaling recession

AP WASHINGTON: The economy jolted into reverse during the third quarter as consumers cut back on their spending by the biggest amount in 28 years, the strongest signal yet the country has hurtled into recession. The broadest barometer of the nation's economic health, gross domestic product, shrank at a 0.3 percent annual rate in the July-September quarter, the Commerce Department reported Thursday. It marked the worst showing since the economy contracted at a 1.4 percent pace in the third quarter of 2001, when the nation was suffering through its last recession. The latest GDP reading marked a rapid loss of traction for the economy, which logged growth of 2.8 percent in the second quarter, and is sure to buttress the belief of many economists that the nation is in the throes of a painful downturn.

"No question. We're definitely in a recession. That is just a reality," said Brian Bethune, economist at IHS Global Insight. The White House tried to downplay the significance of the numbers, saying they were not unexpected and caused partly by special circumstances such as hurricanes and a Boeing Co. strike.

"While we continue to face serious challenges, the United States remains the best place to do business, and we're positioned to bounce back," White House press secretary Dana Perino said. The deterioration reflected a sharp retrenchment by consumers, whose spending accounts for the largest chunk of national economic activity. Consumers ratcheted back their spending at a 3.1 percent pace in the third quarter, the most since the second quarter of 1980, when the country was in the grip of recession. GDP measures the value of all goods and services produced within the United States and is the broadest barometer of the country's economic health. While the third-quarter's contraction wasn't as deep as the 0.5 percent annualized decline analysts expected, the poor showing underscored the terrible toll of the housing, credit and financial crises. J. Steven Landefeld, director of the Commerce Department's Bureau of Economic Analysis, which puts together the GDP report, didn't use the word "recession" to describe economic conditions but said: "Certainly we are seeing a period of dramatic slowdown."

On Wall Street, however, the smaller-than-expected decline gave some comfort to investors. The Dow Jones industrials were up about 80 points in midday trading. Meanwhile, the Labor Department said Thursday that new claims for jobless benefits for the week ending Oct. 25 stood at a seasonally adjusted 479,000, the same as the previous week and above analysts' estimates of 475,000. Jobless claims above 400,000 are considered a sign of a struggling economy. The grim reports come just days before the nation picks the next president on Nov. 4. Whether Democrat Barack Obama or Republican John McCain wins the White House, the incoming president will inherit a deeply troubled economy and a record-high budget deficit that could cramp his domestic agenda. Many economists believe the economy will continue to contract into next year, which would more than meet a classic definition of recession two straight quarters of shrinking GDP. The National Bureau of Economic Research, the panel of experts that determines when U.S. recessions begin and end, uses a broader definition to determine recessions than two quarters of contracting GDP. That didn't happen in the last recession, in 2001. The NBER takes into account income, employment and other barometers. The finding is usually made well after the fact.

A collapse of the housing market and locked up lending have produced the worst financial crisis to hit the country in more than 70 years. To cushion the fallout, the Fed slashed interest rates on Wednesday by half a percentage point to 1 percent, a level seen only once before in the last half century.Fed Chairman Ben Bernanke has warned that the country's economic weakness could last for some time even if the government's unprecedented $700 billion financial bailout package and other steps do succeed in getting financial and credit markets to operate more normally. Unemployment now at 6.1 percent could hit 8 percent or higher next year. Disappearing jobs, battered nest eggs and retirement accounts, and falling home prices are likely to make consumers retrench even more. Underscoring the strain faced by consumers, the report showed that Americans' disposable income fell at an annual rate of 8.7 percent in the third quarter, the largest quarterly drop on records dating back to 1947.

In the third quarter, consumers cut back on purchases of cars, furniture, household appliances, clothes and other things.They pulled back after the bracing impact of the government's tax rebates disappeared. In addition to consumers, businesses cut back sharply in the third quarter. They cut spending on equipment and software at a 5.5 percent pace, the most since the first quarter of 2002, when the economy was struggling to recover from the 2001 recession. Home builders slashed spending at a 19.1 percent pace, marking the 11th straight quarterly cut back, and fresh evidence of the depth of the housing slump. Slower growth for U.S. exports reflecting less demand from overseas buyers who are coping with their own economic problems also factored into the weak GDP report. Exports grew at a 5.9 percent pace in the third quarter, a sharp deceleration from the second quarter's 12.3 percent growth rate. The U.S. economic downturn in the third quarter was accompanied by higher inflation. An inflation gauge tied to the GDP report showed prices excluding food and energy rose at a 2.9 percent pace, up considerably from the 2.2 percent growth rate in the second quarter. Although the new reading is outside the Fed's comfort zone, Fed officials predict the economy's slowdown will damp inflation pressures in the months ahead. The Fed has made clear that its primary mission at the moment is reviving the economy.

Monday, October 27, 2008

Newspapers see sharp circulation drop of 4.6 pct

By ANICK JESDANUN

(AP) — The nation's daily newspapers, already finding advertising revenue fell sharply because of the weak economy, saw circulation decline more steeply than anticipated in the latest reporting period, an auditing agency said Monday. Average weekday circulation was 38,165,848 in the six-months ending in September, a 4.6 percent decline from 40,022,356 a year earlier at the 507 papers that reported circulation totals in both periods. The drop was only 2.6 percent in the September 2007 period, compared with September 2006. In the six-month period that ended in March 2008, the decline was 3.6 percent over a year earlier, according to circulation figures that newspapers submitted to the Audit Bureau of Circulations. Sunday circulation fell even more, 4.8 percent, to 43,631,646 in the latest period at the 571 papers with comparable totals. The drop was 3.5 percent a year ago and 4.6 percent in the period ending in March. Circulation and advertising have been dropping at newspapers as readers continue to migrate to the Internet. Ad revenue began to decline more steeply this summer as the weak economy prompted advertisers to pull back on spending. The sharper circulation declines appear to be a response to that, said Rick Edmonds, media analyst at the journalism think tank Poynter Institute.

(AP) — The nation's daily newspapers, already finding advertising revenue fell sharply because of the weak economy, saw circulation decline more steeply than anticipated in the latest reporting period, an auditing agency said Monday. Average weekday circulation was 38,165,848 in the six-months ending in September, a 4.6 percent decline from 40,022,356 a year earlier at the 507 papers that reported circulation totals in both periods. The drop was only 2.6 percent in the September 2007 period, compared with September 2006. In the six-month period that ended in March 2008, the decline was 3.6 percent over a year earlier, according to circulation figures that newspapers submitted to the Audit Bureau of Circulations. Sunday circulation fell even more, 4.8 percent, to 43,631,646 in the latest period at the 571 papers with comparable totals. The drop was 3.5 percent a year ago and 4.6 percent in the period ending in March. Circulation and advertising have been dropping at newspapers as readers continue to migrate to the Internet. Ad revenue began to decline more steeply this summer as the weak economy prompted advertisers to pull back on spending. The sharper circulation declines appear to be a response to that, said Rick Edmonds, media analyst at the journalism think tank Poynter Institute.

"Times are tough, and they are looking at everything that's in their expense base," he said. "Building new subscribers is an expensive proposition." Some newspapers have purposely let some sales slide to focus on those readers who are coveted by advertisers and exclude those in outlying areas that are more expensive to reach. Circulation could drop even faster as regular readers, in a tight economy, decide they no longer need their printed newspapers, Edmonds warned. Many papers have offset circulation declines with price increases, though papers risk losing readers if they raise prices too much. In a sign of hope, the Newspaper Association of America said last week that usage of newspaper Web sites grew nearly 16 percent in the third quarter, compared with last year, to an average of more than 68 million monthly unique visitors. But online ad sales haven't increased fast enough to offset the declines in print, which still makes up the bulk of a paper's revenue. USA Today remains the nation's top-selling newspaper, with average daily circulation of 2,293,310, just 173 more than last year. The No. 2 daily, The Wall Street Journal, also reported flat circulation — up just 117 copies to 2,011,999.

The New York Times saw circulation decline 3.6 percent to 1,000,665, while the Los Angeles Times had a 5.2 percent drop to 739,147. The other papers in the top 25 also saw circulation drops of from 1.9 percent at The Washington Post to 13.6 percent at The Atlanta Journal-Constitution. The New York Times remains the top paper on Sundays, when USA Today and the Journal do not publish, with a circulation of 1,438,585, down 4.1 percent. The Los Angeles Times follows at 1,055,076, down 5.1 percent, and the Post at 866,057, a decrease of 3.2 percent. Among the top 25, only the St. Louis Post-Dispatch and the St. Petersburg (Fla.) Times reported Sunday gains, of 0.8 percent and 0.1 percent, respectively. Despite the industrywide decline in circulation, five papers outside the top 25 reported gains of at least 5 percent, led by the Wisconsin State Journal of Madison, where circulation rose 10.6 percent to 97,012. The other gainers are The Macomb Daily of Mount Clemens, Mich., The Daily Sun of The Villages, Fla., The Times of Trenton, N.J., and the Citizen Tribune of Morristown, Tenn.

(AP) — The nation's daily newspapers, already finding advertising revenue fell sharply because of the weak economy, saw circulation decline more steeply than anticipated in the latest reporting period, an auditing agency said Monday. Average weekday circulation was 38,165,848 in the six-months ending in September, a 4.6 percent decline from 40,022,356 a year earlier at the 507 papers that reported circulation totals in both periods. The drop was only 2.6 percent in the September 2007 period, compared with September 2006. In the six-month period that ended in March 2008, the decline was 3.6 percent over a year earlier, according to circulation figures that newspapers submitted to the Audit Bureau of Circulations. Sunday circulation fell even more, 4.8 percent, to 43,631,646 in the latest period at the 571 papers with comparable totals. The drop was 3.5 percent a year ago and 4.6 percent in the period ending in March. Circulation and advertising have been dropping at newspapers as readers continue to migrate to the Internet. Ad revenue began to decline more steeply this summer as the weak economy prompted advertisers to pull back on spending. The sharper circulation declines appear to be a response to that, said Rick Edmonds, media analyst at the journalism think tank Poynter Institute.

(AP) — The nation's daily newspapers, already finding advertising revenue fell sharply because of the weak economy, saw circulation decline more steeply than anticipated in the latest reporting period, an auditing agency said Monday. Average weekday circulation was 38,165,848 in the six-months ending in September, a 4.6 percent decline from 40,022,356 a year earlier at the 507 papers that reported circulation totals in both periods. The drop was only 2.6 percent in the September 2007 period, compared with September 2006. In the six-month period that ended in March 2008, the decline was 3.6 percent over a year earlier, according to circulation figures that newspapers submitted to the Audit Bureau of Circulations. Sunday circulation fell even more, 4.8 percent, to 43,631,646 in the latest period at the 571 papers with comparable totals. The drop was 3.5 percent a year ago and 4.6 percent in the period ending in March. Circulation and advertising have been dropping at newspapers as readers continue to migrate to the Internet. Ad revenue began to decline more steeply this summer as the weak economy prompted advertisers to pull back on spending. The sharper circulation declines appear to be a response to that, said Rick Edmonds, media analyst at the journalism think tank Poynter Institute."Times are tough, and they are looking at everything that's in their expense base," he said. "Building new subscribers is an expensive proposition." Some newspapers have purposely let some sales slide to focus on those readers who are coveted by advertisers and exclude those in outlying areas that are more expensive to reach. Circulation could drop even faster as regular readers, in a tight economy, decide they no longer need their printed newspapers, Edmonds warned. Many papers have offset circulation declines with price increases, though papers risk losing readers if they raise prices too much. In a sign of hope, the Newspaper Association of America said last week that usage of newspaper Web sites grew nearly 16 percent in the third quarter, compared with last year, to an average of more than 68 million monthly unique visitors. But online ad sales haven't increased fast enough to offset the declines in print, which still makes up the bulk of a paper's revenue. USA Today remains the nation's top-selling newspaper, with average daily circulation of 2,293,310, just 173 more than last year. The No. 2 daily, The Wall Street Journal, also reported flat circulation — up just 117 copies to 2,011,999.

The New York Times saw circulation decline 3.6 percent to 1,000,665, while the Los Angeles Times had a 5.2 percent drop to 739,147. The other papers in the top 25 also saw circulation drops of from 1.9 percent at The Washington Post to 13.6 percent at The Atlanta Journal-Constitution. The New York Times remains the top paper on Sundays, when USA Today and the Journal do not publish, with a circulation of 1,438,585, down 4.1 percent. The Los Angeles Times follows at 1,055,076, down 5.1 percent, and the Post at 866,057, a decrease of 3.2 percent. Among the top 25, only the St. Louis Post-Dispatch and the St. Petersburg (Fla.) Times reported Sunday gains, of 0.8 percent and 0.1 percent, respectively. Despite the industrywide decline in circulation, five papers outside the top 25 reported gains of at least 5 percent, led by the Wisconsin State Journal of Madison, where circulation rose 10.6 percent to 97,012. The other gainers are The Macomb Daily of Mount Clemens, Mich., The Daily Sun of The Villages, Fla., The Times of Trenton, N.J., and the Citizen Tribune of Morristown, Tenn.

Wednesday, October 22, 2008

Wells Fargo Chairman Prefers U.S. Plan to Buy Stakes

(Bloomberg) -- Wells Fargo & Co. Chairman Richard Kovacevich said the U.S. Treasury's intention to buy stock in banks provides a better stimulus to escape the financial crisis than an earlier plan to purchase soured mortgage-related assets.

(Bloomberg) -- Wells Fargo & Co. Chairman Richard Kovacevich said the U.S. Treasury's intention to buy stock in banks provides a better stimulus to escape the financial crisis than an earlier plan to purchase soured mortgage-related assets.``Direct capital injections versus buying loans is a far more preferable way'' to help companies already facing credit losses, Kovacevich, 64, said yesterday at an event hosted by San Francisco's Commonwealth Club. ``It's an important tool to get the financial system back into the money business again.'' Wells Fargo, which agreed to buy Wachovia Corp. for about $14 billion this month, is one of nine large lenders slated to receive cash infusions as part of the government's plan to spend $700 billion unfreezing credit markets. Wells Fargo, based in San Francisco, will get $25 billion. JPMorgan Chase & Co., Citigroup Inc. and Goldman Sachs Group Inc. are among the others that will receive the cash.

U.S. Treasury Secretary Henry Paulson last week urged banks to ``deploy'' the money in loans. He was forced to change his strategy after the initial plan to buy distressed assets caused banks to hoard cash and failed to halt a slide in the stock market. Kovacevich declined to say if he initially opposed Paulson's plan as the New York Times reported. Wells Fargo dropped 99 cents, or 3 percent, to $31.65 at 10:04 a.m. in New York Stock Exchange composite trading. The shares gained 8.1 percent this year through yesterday, the biggest advance in the 24-comopany KBW Bank Index. Wachovia fell 17 cents to $5.92, adding to its 84 percent decline this year.

He's Seen Worse

Kovacevich said the current economic crisis isn't the worst he's seen, and the U.S. government's may help end the credit freeze ``reasonably soon.''

``Our customers, except those in residential home lending or autos, are doing quite well,'' he said. ``By far, the worst economic crisis of my career was in the 1980s.'' The Wachovia deal, orchestrated by Kovacevich, marks an eastward expansion and strategic shift for Wells Fargo, which maintained a profit during the financial crisis by avoiding riskier loans. Wachovia's mortgage portfolio includes an estimated $74 billion in future losses. The Wells Fargo-Wachovia deal will create the biggest U.S. bank network, with 6,675 branches. The Federal Reserve said yesterday that Wells Fargo agreed to reduce its deposit base to comply with U.S. bank-merger law should the combined company control more than 10 percent of deposits nationwide.

Wachovia reported its third straight quarterly loss today, hurt by crumbling mortgage markets and writedowns on securities backed by real estate. The loss for the three months ended Sept. 30 was $23.9 billion, or $11.18 a share, compared with net income of $1.6 billion, or 85 cents, in the same period a year earlier, the Charlotte, North Carolina-based company said in a statement. The Wachovia deal would be Wells Fargo's biggest acquisition since Norwest Corp. purchased the old Wells Fargo 10 years ago and adopted the name. Kovacevich was chief operating officer at Minneapolis-based Norwest in the 1980s when current Wells Fargo Chief Executive Officer John Stumpf, 55, was running the auto-dealer business and working on commercial loans. Kovacevich was promoted to CEO of Norwest in 1993 and stepped down in June 2007 to make way for the promotion of Stumpf, who has been with the company for 26 years.

Let 'Em Ride

I haven't been playing much online poker since my party poker days at college but I've recently been getting into some of the new casino sites that offer table games. A friend of mine recommended a new German casino www.casino.de that is absolutely fabulous. They've got a great blackjack game and my favorite craps. Craps is possibly the most fun table game in casinos and although it's dangerous, can provide hours of fun online. There's nothing like being on a roll in craps. I remember being at the Luxor a few years ago and turning my gas money (that's all I had left after getting killed in blackjack) into a grand on the last night in the casino. The shooter at the table didn't crap out for 2 hours! I'll probably be gambling less after losing a lot in the markets this month but there will always be a place in my heart for that Las Vegas action that you can now get online. This casino is great because not only can I enjoy the gaming, I can also brush up on my German which I've used less and less since my days in Berlin. I'd be wary of spending too much on gambling, but the game play is great and if you can't make it to Vegas or Atlantic City (and you speak German) check our their site for good times. Good Luck!

Thursday, September 25, 2008

Deal close on $700 billion financial bailout plan

By JULIE HIRSCHFELD DAVIS

WASHINGTON (AP) - President Bush is bringing presidential candidates Barack Obama and John McCain into negotiations on a $700 billion rescue of Wall Street as Democrats and Republicans near agreement on a bailout plan with more protections for taxpayers and new help for distressed homeowners. Senior lawmakers and Bush administration officials have cleared away key obstacles to a deal on the unprecedented rescue, agreeing to include widely supported limits on pay packages for executives whose companies benefit. They're still wrangling over major elements, including how to phase in the eye-popping cost - a measure demanded by Democrats and some Republicans who want stronger congressional control over the bailout - without spooking markets. A plan to let the government take an ownership stake in troubled companies as part of the rescue, rather than just buying bad debt, also was under intense negotiation. A bipartisan meeting was set for Thursday to begin drafting a compromise, which top Democrats said they hoped could pass within days.

The core of the plan envisions the government buying up sour assets of shaky financial firms in a bid to keep them from going under and to stave off a potentially severe recession. Bush acknowledged in a prime-time television address Wednesday night that the bailout would be a "tough vote" for lawmakers. But he said failing to approve it would risk dire consequences for the economy and most Americans.

"Without immediate action by Congress, America could slip into a financial panic, and a distressing scenario would unfold," Bush said as he worked to resurrect the unpopular bailout package. "Our entire economy is in danger." Bush's warning came soon after he invited Obama and McCain, one of whom will inherit the economic mess in four months, as well as key congressional leaders to a White House meeting Thursday to work on a compromise. With the administration's original proposal considered dead in Congress, House leaders said they were making progress toward revised legislation that could be approved. Rep. Barney Frank, D-Mass., who has led negotiations with Treasury Secretary Henry Paulson on the package, said that given the progress of the talks, the White House meeting was a distraction.

"We're going to have to interrupt a negotiating session tomorrow between the Democrats and Republicans on a bill where I think we are getting pretty close, and troop down to the White House for their photo op," said Frank, the House Financial Services Committee chairman. "I wish they'd checked with us." Paulson and Federal Reserve Chairman Ben Bernanke have been crisscrossing Capitol Hill in recent days, shuttling between public hearings on the proposal and private meetings with lawmakers, to sell the proposal. Obama and McCain are calling for a bipartisan effort to deal with the crisis, little more than five weeks before national elections in which the economy has emerged as the dominant theme.

"The plan that has been submitted to Congress by the Bush administration is flawed, but the effort to protect the American economy must not fail," they said in a joint statement Wednesday night. "This is a time to rise above politics for the good of the country. We cannot risk an economic catastrophe." Presidential politics intruded, nonetheless, when McCain said earlier Wednesday he intended to return to Washington and was asking Obama to agree to delay their first debate, scheduled for Friday, to deal with the meltdown. Obama said the debate should go ahead. Lawmakers in both parties have objected strenuously to the rescue plan over the past two days, Republicans complaining about federal intervention in private business and Democrats pressing to tack on more conditions and help for beleaguered homeowners. But many in both parties said they were open to legislation, although on different terms than the White House has proposed. Some partisan sticking points remain. Democrats are pushing to allow bankruptcy judges to rewrite mortgages to ease the burden on consumers who are facing foreclosure - a nonstarter for Republicans.

Democrats acknowledge privately that the provision will almost certainly be dropped in the interest of a bipartisan deal. Obama told reporters it's "probably something that we shouldn't try to do in this piece of legislation." Democrats also want any potential proceeds the government reaps from the bailout to go to a fund designed to pay for housing for poor families. Many Republicans oppose the very existence of the fund, which they say is a backdoor means of funneling money to liberal political groups. Democratic demands that Congress be given greater authority over the bailout and that the government be required to help homeowners renegotiate their mortgages so they have lower monthly payments already have been accepted in principle. Under the bailout bill, which will let the government buy huge amounts of toxic mortgage-related assets, "we're now the biggest mortgage holder in town, and we can do serious foreclosure avoidance," Frank said.

WASHINGTON (AP) - President Bush is bringing presidential candidates Barack Obama and John McCain into negotiations on a $700 billion rescue of Wall Street as Democrats and Republicans near agreement on a bailout plan with more protections for taxpayers and new help for distressed homeowners. Senior lawmakers and Bush administration officials have cleared away key obstacles to a deal on the unprecedented rescue, agreeing to include widely supported limits on pay packages for executives whose companies benefit. They're still wrangling over major elements, including how to phase in the eye-popping cost - a measure demanded by Democrats and some Republicans who want stronger congressional control over the bailout - without spooking markets. A plan to let the government take an ownership stake in troubled companies as part of the rescue, rather than just buying bad debt, also was under intense negotiation. A bipartisan meeting was set for Thursday to begin drafting a compromise, which top Democrats said they hoped could pass within days.

The core of the plan envisions the government buying up sour assets of shaky financial firms in a bid to keep them from going under and to stave off a potentially severe recession. Bush acknowledged in a prime-time television address Wednesday night that the bailout would be a "tough vote" for lawmakers. But he said failing to approve it would risk dire consequences for the economy and most Americans.

"Without immediate action by Congress, America could slip into a financial panic, and a distressing scenario would unfold," Bush said as he worked to resurrect the unpopular bailout package. "Our entire economy is in danger." Bush's warning came soon after he invited Obama and McCain, one of whom will inherit the economic mess in four months, as well as key congressional leaders to a White House meeting Thursday to work on a compromise. With the administration's original proposal considered dead in Congress, House leaders said they were making progress toward revised legislation that could be approved. Rep. Barney Frank, D-Mass., who has led negotiations with Treasury Secretary Henry Paulson on the package, said that given the progress of the talks, the White House meeting was a distraction.

"We're going to have to interrupt a negotiating session tomorrow between the Democrats and Republicans on a bill where I think we are getting pretty close, and troop down to the White House for their photo op," said Frank, the House Financial Services Committee chairman. "I wish they'd checked with us." Paulson and Federal Reserve Chairman Ben Bernanke have been crisscrossing Capitol Hill in recent days, shuttling between public hearings on the proposal and private meetings with lawmakers, to sell the proposal. Obama and McCain are calling for a bipartisan effort to deal with the crisis, little more than five weeks before national elections in which the economy has emerged as the dominant theme.

"The plan that has been submitted to Congress by the Bush administration is flawed, but the effort to protect the American economy must not fail," they said in a joint statement Wednesday night. "This is a time to rise above politics for the good of the country. We cannot risk an economic catastrophe." Presidential politics intruded, nonetheless, when McCain said earlier Wednesday he intended to return to Washington and was asking Obama to agree to delay their first debate, scheduled for Friday, to deal with the meltdown. Obama said the debate should go ahead. Lawmakers in both parties have objected strenuously to the rescue plan over the past two days, Republicans complaining about federal intervention in private business and Democrats pressing to tack on more conditions and help for beleaguered homeowners. But many in both parties said they were open to legislation, although on different terms than the White House has proposed. Some partisan sticking points remain. Democrats are pushing to allow bankruptcy judges to rewrite mortgages to ease the burden on consumers who are facing foreclosure - a nonstarter for Republicans.

Democrats acknowledge privately that the provision will almost certainly be dropped in the interest of a bipartisan deal. Obama told reporters it's "probably something that we shouldn't try to do in this piece of legislation." Democrats also want any potential proceeds the government reaps from the bailout to go to a fund designed to pay for housing for poor families. Many Republicans oppose the very existence of the fund, which they say is a backdoor means of funneling money to liberal political groups. Democratic demands that Congress be given greater authority over the bailout and that the government be required to help homeowners renegotiate their mortgages so they have lower monthly payments already have been accepted in principle. Under the bailout bill, which will let the government buy huge amounts of toxic mortgage-related assets, "we're now the biggest mortgage holder in town, and we can do serious foreclosure avoidance," Frank said.

Bush Warns "Entire Economy Is In Danger"

Media reports are casting President Bush's televised address last night as both a warning to the nation on the severity of the financial crisis and an attempt to push Congress into passing his proposed bailout. A number of the stories remark on Bush's stark warnings about the health of the economy. Roll Call, for example, says Bush "sketched a frightening view of the economic danger," and used "unusually blunt and even dramatic language." The New York Times reports Bush told the country that "'a long and painful recession' could occur if Congress does not act quickly." Like many other media outlets this morning, the Times quotes the President saying, "Our entire economy is in danger." Bush's speech highlighted "a growing sense of urgency on the part of the administration that Congress must act to avert a far-reaching economic collapse." USA Today notes the President also said, "Without immediate action by Congress, America could slip into a financial panic. ... More banks could fail, including some in your community." He also "warned that inaction could cause millions of layoffs, bank failures, business closures, lost retirement savings, more foreclosures, a further drying up of credit." McClatchy, Los Angeles Times and Washington Post run similar reports.

The speech is also seen as a response to critics who accused the President of not having played a lead role in the government's efforts to defuse the crisis. USA Today reports, for example, that Bush faced "criticism from some Democrats for being AWOL in the debate," and the Wall Street Journal says that "until now," the President had "relied largely on Treasury Secretary Henry Paulson -- a former Goldman Sachs CEO -- and Federal Reserve Chairman Ben Bernanke to make the case for the plan," but "Republican support has been so soft that Democrats worried they would have to take on most of the responsibility -- and political risk -- for passing the package." And "to spread that risk, Democrats on Tuesday called on Mr. Bush to address the nation."

The Politico describes Paulson as "the captain of a crowded lifeboat" who "struggled to stay afloat in Congress Wednesday, battling the waves crashing in on his Wall Street rescue plan." With his speech, Bush was "lending a hand" and taking "back the helm long enough Wednesday night to deliver a nationally televised address," but "to the surprise of some in his own administration, Bush spent precious political capital by using the speech to try to help McCain by bringing him into what have been delicate negotiations with Congress."

McCain, Obama To Attend White House Talks Today The AP notes Bush "spoke just after inviting Democrat Sen. Barack Obama and Republican Sen. John McCain, one of whom will inherit the mess in four months, and key congressional leaders to an extraordinary White House meeting Thursday to hammer out a compromise." In his speech, the President "explicitly endorsed several of the changes that have been demanded in recent days from the right and left. But he warned that he would draw the line at regulations he determined would hamper economic growth." Another AP story and a report in the Los Angeles Times, among other media stories, note both Obama and McCain have said they will attend the meeting.

Wednesday, September 10, 2008

Lehman: Too big to fail?

By Paul R. La Monica, CNNMoney.com editor

NEW YORK (CNNMoney.com) -- Lehman Brothers has finally announced a path to raising capital. But after Tuesday's 45% plunge in its stock price, it's unclear if Wall Street will let chief executive officer Richard Fuld carry out the plan. Lehman's (LEH, Fortune 500) stock was down about 2% late Wednesday morning after the company said it would slash its dividend, look for a buyer of the majority of its Neuberger Berman investment management unit and spin off part of its commercial real estate business. Shares are trading at their lowest point in 10 years, having plummeted nearly 90% so far this year. And by the way, the company lost $3.9 billion in the third quarter. So now, the natural question that needs to be asked is this: On the heels of the Treasury Department's takeover of mortgage giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500), does the government now have to step in and bailout Lehman as well. Unfortunately, it may have no choice.

NEW YORK (CNNMoney.com) -- Lehman Brothers has finally announced a path to raising capital. But after Tuesday's 45% plunge in its stock price, it's unclear if Wall Street will let chief executive officer Richard Fuld carry out the plan. Lehman's (LEH, Fortune 500) stock was down about 2% late Wednesday morning after the company said it would slash its dividend, look for a buyer of the majority of its Neuberger Berman investment management unit and spin off part of its commercial real estate business. Shares are trading at their lowest point in 10 years, having plummeted nearly 90% so far this year. And by the way, the company lost $3.9 billion in the third quarter. So now, the natural question that needs to be asked is this: On the heels of the Treasury Department's takeover of mortgage giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500), does the government now have to step in and bailout Lehman as well. Unfortunately, it may have no choice.

Talkback: Do you think Lehman should be allowed to fail or does it need to be bailed out?

The Federal Reserve set a dangerous precedent in March when it helped engineer the takeover of Bear Stearns by JPMorgan Chase (JPM, Fortune 500) by agreeing to guarantee $29 billion in potential losses. Since then, several Fed members, most notably chief Ben Bernanke, have gone out of their way to defend the action, arguing that Bear Stearns simply was too big to fail. The repercussions of allowing Bear to collapse could have been catastrophic. So if Bear was determined to be too big to fail, isn't it likely the Fed would think Lehman is as well?

Probably. That's because Lehman, the fourth-largest investment bank, is bigger than Bear, which was the fifth-largest at the time it nearly imploded. What's more, Lehman, a bond-trading powerhouse, is even a bigger player in the mortgage-backed securities market than Bear was. So the Fed could easily argue that letting Lehman go under could create even more chaos in the already volatile credit markets. Yes, Fuld wants to keep the bank independent by taking a piecemeal approach to breaking up the company. But the market may not let him do so. And until Lehman actually announces that it has, in fact, raised a substantial amount of capital, it's likely that there will be continued pressure on the stock. If Lehman's stock falls further, it's reasonable to think that some financial institution would take a gamble on buying the company, especially if it could get Lehman through a "takeunder" just as JPMorgan did with Bear.

Some analysts have tossed out investment manager BlackRock (BLK, Fortune 500), British bank HSBC (HBC) and private equity firm Blackstone (BX) as potential bidders. But why would any of them agree to take on all the risk without some assurance from the Fed? After all, that's exactly what JPMorgan got in the Bear deal. Don't get me wrong. I don't like the notion of big Wall Street firms getting saved after making irresponsible, reckless decisions. In what's supposed to be a free market, companies should be allowed to fail. But the Fed has already opened Pandora's box. It's too late now to say that Lehman should be left to wither away to nothing while Bear was allowed to escape that fate. To be sure, if one of the three aforementioned firms were to try and buy Lehman and wanted the Fed's help, this would be more complicated than the JPMorgan takeover. BlackRock and Blackstone aren't banks. And HSBC is not a U.S.-headquartered institution.

Still, Bernanke and Fed vice chairman Tim Geithner have demonstrated a remarkable willingness to be flexible and creative in dealing with the credit crunch. So if they wanted to help someone buy Lehman, one would think they would find a way to get it done. Like it or not, the age of the bailout is in full swing. To top of page

NEW YORK (CNNMoney.com) -- Lehman Brothers has finally announced a path to raising capital. But after Tuesday's 45% plunge in its stock price, it's unclear if Wall Street will let chief executive officer Richard Fuld carry out the plan. Lehman's (LEH, Fortune 500) stock was down about 2% late Wednesday morning after the company said it would slash its dividend, look for a buyer of the majority of its Neuberger Berman investment management unit and spin off part of its commercial real estate business. Shares are trading at their lowest point in 10 years, having plummeted nearly 90% so far this year. And by the way, the company lost $3.9 billion in the third quarter. So now, the natural question that needs to be asked is this: On the heels of the Treasury Department's takeover of mortgage giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500), does the government now have to step in and bailout Lehman as well. Unfortunately, it may have no choice.

NEW YORK (CNNMoney.com) -- Lehman Brothers has finally announced a path to raising capital. But after Tuesday's 45% plunge in its stock price, it's unclear if Wall Street will let chief executive officer Richard Fuld carry out the plan. Lehman's (LEH, Fortune 500) stock was down about 2% late Wednesday morning after the company said it would slash its dividend, look for a buyer of the majority of its Neuberger Berman investment management unit and spin off part of its commercial real estate business. Shares are trading at their lowest point in 10 years, having plummeted nearly 90% so far this year. And by the way, the company lost $3.9 billion in the third quarter. So now, the natural question that needs to be asked is this: On the heels of the Treasury Department's takeover of mortgage giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500), does the government now have to step in and bailout Lehman as well. Unfortunately, it may have no choice.Talkback: Do you think Lehman should be allowed to fail or does it need to be bailed out?

The Federal Reserve set a dangerous precedent in March when it helped engineer the takeover of Bear Stearns by JPMorgan Chase (JPM, Fortune 500) by agreeing to guarantee $29 billion in potential losses. Since then, several Fed members, most notably chief Ben Bernanke, have gone out of their way to defend the action, arguing that Bear Stearns simply was too big to fail. The repercussions of allowing Bear to collapse could have been catastrophic. So if Bear was determined to be too big to fail, isn't it likely the Fed would think Lehman is as well?

Probably. That's because Lehman, the fourth-largest investment bank, is bigger than Bear, which was the fifth-largest at the time it nearly imploded. What's more, Lehman, a bond-trading powerhouse, is even a bigger player in the mortgage-backed securities market than Bear was. So the Fed could easily argue that letting Lehman go under could create even more chaos in the already volatile credit markets. Yes, Fuld wants to keep the bank independent by taking a piecemeal approach to breaking up the company. But the market may not let him do so. And until Lehman actually announces that it has, in fact, raised a substantial amount of capital, it's likely that there will be continued pressure on the stock. If Lehman's stock falls further, it's reasonable to think that some financial institution would take a gamble on buying the company, especially if it could get Lehman through a "takeunder" just as JPMorgan did with Bear.

Some analysts have tossed out investment manager BlackRock (BLK, Fortune 500), British bank HSBC (HBC) and private equity firm Blackstone (BX) as potential bidders. But why would any of them agree to take on all the risk without some assurance from the Fed? After all, that's exactly what JPMorgan got in the Bear deal. Don't get me wrong. I don't like the notion of big Wall Street firms getting saved after making irresponsible, reckless decisions. In what's supposed to be a free market, companies should be allowed to fail. But the Fed has already opened Pandora's box. It's too late now to say that Lehman should be left to wither away to nothing while Bear was allowed to escape that fate. To be sure, if one of the three aforementioned firms were to try and buy Lehman and wanted the Fed's help, this would be more complicated than the JPMorgan takeover. BlackRock and Blackstone aren't banks. And HSBC is not a U.S.-headquartered institution.

Still, Bernanke and Fed vice chairman Tim Geithner have demonstrated a remarkable willingness to be flexible and creative in dealing with the credit crunch. So if they wanted to help someone buy Lehman, one would think they would find a way to get it done. Like it or not, the age of the bailout is in full swing. To top of page

Wednesday, August 27, 2008

Fewer without health insurance, U.S. Census says

By Ruth Mantell

WASHINGTON (MarketWatch) -- Even as the number of Americans living in poverty rose last year, fewer Americans overall went without health insurance and there was an increase in the median household income adjusted for inflation, the Census Bureau reported Tuesday. The number of people without health-insurance coverage fell to 45.7 million in 2007 from 47 million in 2006, the government said in its annual snapshot. The number of uninsured children also declined, slipping to 8.1 million from 8.7 million. Median household income, adjusted for inflation, rose 1.3% to $50,233 -- the highest level since 2000. Income includes items such as earnings, interest, alimony and unemployment compensation. For households at the 20th percentile, income fell 1.5% to $20,291. For households at the 80th percentile, income rose less than a percentage point to $100,000.

Meanwhile, following three years of annual declines in real earnings, both men and women experienced gains in 2007. The real median earnings for men working full-time and on a year-round basis rose 3.8% to $45,113, with women's earnings growing by 5% to $35,102. The poverty rate hit 12.5% in 2007, compared with 12.3% in the prior year -- not statistically different, according to the Census Bureau. The poverty rate reached 11.7% in 2001, when the economy was in a recession. The number of Americans living under the poverty line reached 37.3 million, including 13.3 million children. In the prior year, there were 36.5 million under the poverty line, 12.8 million of whom were children.

Cause for concern

Despite some good news in the data, there is also cause for concern, according to the Center on Budget and Policy Priorities, a policy and research organization that specializes in programs that affect low- and moderate-income families and individuals. In particular, the rate of those without health insurance hit 15.3% in 2007, up from 14.1% in 2001. "The data for 2007 are of particular concern given that the economy is now in a slowdown, and poverty is almost certainly higher now -- and incomes lower -- than in 2007," said Robert Greenstein, CBPP's executive director.

"The 2007 levels -- already disappointing because they are worse than those for the 2001 recession -- are likely to constitute a high-water mark for the next few years. This suggests that significant pain may lie ahead for many Americans," he commented in a statement. Dr. Nancy Nielsen, president of the American Medical Association, said in a statement that many patients are priced out of coverage, and that covering all Americans would be a "good first step."

"We advocate for a shift in tax incentives for health insurance so lower-income Americans get money to purchase coverage," she added. "We also want insurance-market reforms to provide individuals more choices and ensure coverage for high-risk patients." CBPP estimates that the absolute number of Americans and the percentage of the overall population who are uninsured can be expected to increase both this year and next. "The numbers of uninsured parents and children are likely to grow as employers lay off more workers and states consider cuts in their Medicaid programs to help balance their budgets during the economic slowdown," Greenstein said.

WASHINGTON (MarketWatch) -- Even as the number of Americans living in poverty rose last year, fewer Americans overall went without health insurance and there was an increase in the median household income adjusted for inflation, the Census Bureau reported Tuesday. The number of people without health-insurance coverage fell to 45.7 million in 2007 from 47 million in 2006, the government said in its annual snapshot. The number of uninsured children also declined, slipping to 8.1 million from 8.7 million. Median household income, adjusted for inflation, rose 1.3% to $50,233 -- the highest level since 2000. Income includes items such as earnings, interest, alimony and unemployment compensation. For households at the 20th percentile, income fell 1.5% to $20,291. For households at the 80th percentile, income rose less than a percentage point to $100,000.

Meanwhile, following three years of annual declines in real earnings, both men and women experienced gains in 2007. The real median earnings for men working full-time and on a year-round basis rose 3.8% to $45,113, with women's earnings growing by 5% to $35,102. The poverty rate hit 12.5% in 2007, compared with 12.3% in the prior year -- not statistically different, according to the Census Bureau. The poverty rate reached 11.7% in 2001, when the economy was in a recession. The number of Americans living under the poverty line reached 37.3 million, including 13.3 million children. In the prior year, there were 36.5 million under the poverty line, 12.8 million of whom were children.

Cause for concern

Despite some good news in the data, there is also cause for concern, according to the Center on Budget and Policy Priorities, a policy and research organization that specializes in programs that affect low- and moderate-income families and individuals. In particular, the rate of those without health insurance hit 15.3% in 2007, up from 14.1% in 2001. "The data for 2007 are of particular concern given that the economy is now in a slowdown, and poverty is almost certainly higher now -- and incomes lower -- than in 2007," said Robert Greenstein, CBPP's executive director.

"The 2007 levels -- already disappointing because they are worse than those for the 2001 recession -- are likely to constitute a high-water mark for the next few years. This suggests that significant pain may lie ahead for many Americans," he commented in a statement. Dr. Nancy Nielsen, president of the American Medical Association, said in a statement that many patients are priced out of coverage, and that covering all Americans would be a "good first step."

"We advocate for a shift in tax incentives for health insurance so lower-income Americans get money to purchase coverage," she added. "We also want insurance-market reforms to provide individuals more choices and ensure coverage for high-risk patients." CBPP estimates that the absolute number of Americans and the percentage of the overall population who are uninsured can be expected to increase both this year and next. "The numbers of uninsured parents and children are likely to grow as employers lay off more workers and states consider cuts in their Medicaid programs to help balance their budgets during the economic slowdown," Greenstein said.

Tuesday, August 19, 2008

U.S. Producer Prices Surge More Than Forecast in July

U.S. Producer Prices Surge More Than Forecast in July (Update2)

By Timothy R. Homan(Bloomberg) -- Prices paid to U.S. producers rose twice as much as economists had forecast in July, reflecting the jump in energy and commodity costs that has since started to wane. The 1.2 percent increase in the producer price index followed a 1.8 percent increase the prior month, the Labor Department said today in Washington. Costs were up the most in 27 years from a year before. So-called core prices that exclude fuel and food rose 0.7 percent after a 0.2 percent gain in June. Oil prices have dropped 21 percent since the start of last month, copper is down 15 percent and corn has dropped 14 percent, helping ease the cost pressures on companies. Federal Reserve officials anticipate the economic slowdown, along with a stabilization in commodity costs, will help contain inflation.